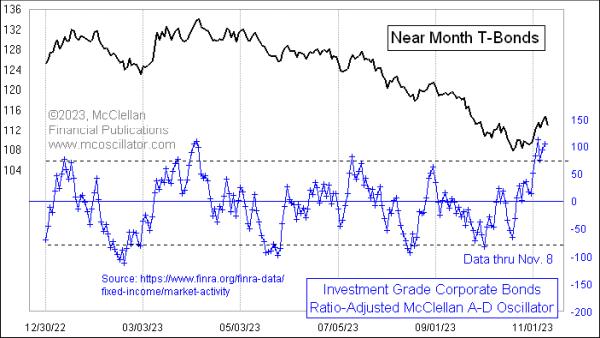

The McClellan Oscillator for Investment Grade Bonds (MOCIG) is a technical indicator used by investors to identify trends in the bond marketplace. It was developed by Jim McClellan, a well-known Wall Street analyst, who has developed several technical indicators that have withstood the test of time. The MOCIG is an oscillator that measures the relationship between the volume of sold bonds and the volume of bought bonds and gives an indication of the direction of the trend.

The MOCIG is computed using the following formula:

MOCIG = (Volume of sold Bonds / Volume of bought Bonds) x 100

If the result is positive, it means that the market preference is for buying bonds. On the other hand, if the result is negative, it indicates that the market preference is to sell bonds.

The MOCIG is a reliable indicator of short-term trends in the bond market, as it accurately reflects the buying and selling dynamics over the near-term. It is especially useful for investors who are looking to gain insights into shifts in the bond market.

The MOCIG measures the breadth of the bond market and can help investors determine which bond sectors are doing well and which are performing poorly. By observing the MOCIG, investors can determine whether momentum is building or waning in certain bond markets.

Additionally, investors can use the MOCIG to identify possible overbought or oversold conditions in the bond market. If the MOCIG is in an extremely high positive range, it indicates that the market is overbought and investors should be cautious about buying. Similarly, if the MOCIG is in an extremely low negative range, it indicates that the market is oversold and investors should be cautious about selling.

In summary, the McClellan Oscillator for Investment Grade Bonds is a technical indicator that measures the breadth of the bond market. It helps investors identify short-term trends in the bond marketplace and is especially useful for identifying overbought or oversold conditions in the bond market. By utilizing the MOCIG, investors can more effectively make informed investment decisions in the bond market.