Tapping into the power of sector rotation generally requires greater knowledge and experience than the average investor has. However, for those investors and traders who understand the intricacies of this strategy, sector rotation can be one of the most profitable investments in the technology sector.

Sector rotation is the process of adjusting exposure to different sectors of the market based on their relative performance. This type of strategy can be used in any market but it has been particularly effective in the technology sector with the sector’s strong seasonality pattern.

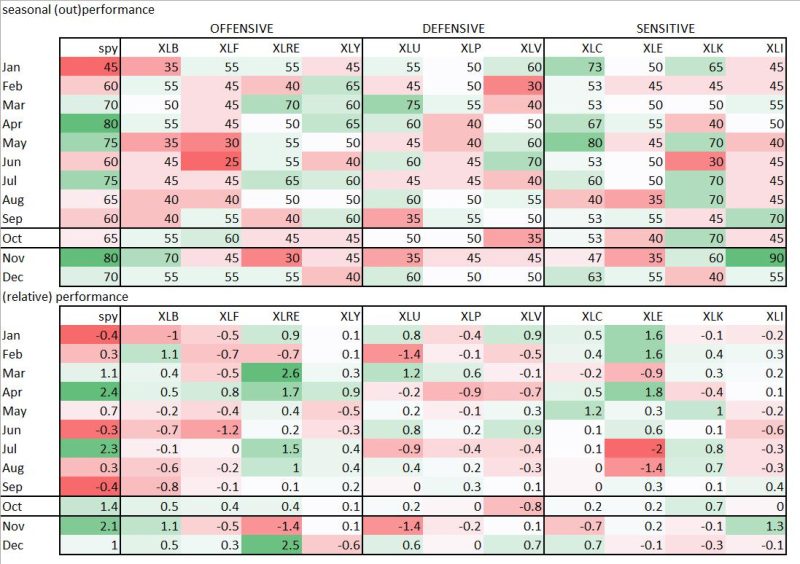

Understanding and utilizing sector rotation requires an understanding of the fundamentals of each sector that is being traded. This includes understanding how each sector behaves during specific times of year and how they are affected by different market catalysts.

For example, the technology sector has a well-defined cyclical pattern that has become a target of investors who are utilizing sector rotation. Technology stocks tend to perform well during the summer months and the late fourth quarter of the year as these are the times when new products are launched and sales spike.

Understanding this pattern and how it plays out has allowed investors to successfully rotate out of underperforming sectors and into the technology sector. During the summer months, investors can invest in the technology sector when the sector is outperforming other sectors and then rotate out of it when the market becomes overbought or stagnant. This allows investors to profit as they take advantage of the cyclical patterns in the technology sector.

Rotation out of technology into other sectors such as health care and consumer staples can be a profitable strategy as well. These sectors tend to be more stable, offering investors downside protection during times of market volatility.

Sector rotation strategies are not without their risks, however. Many investors have found themselves on the wrong side of the market if they fail to understand the fundamentals of the sectors they are trading. Additionally, the technology sector is highly cyclical, which means that investors could miss out on potential profits if they fail to time their trades correctly.

In conclusion, sector rotation is an extremely valuable tool for those investors who understand how to execute it properly. By understanding the different seasonality patterns of different sectors, investors can profit from changes in their particular sectors. However, investors must remain aware of the risks involved in sector rotation, as it could easily lead to large losses if not executed properly.