With the ever-changing and volatile effects of the stock market, projections on stock performance can be made difficult. To help anticipate the future of the markets, many investors turn to what’s known as the Put/Call Ratio (PCR). The PCR is a tool used by traders to compare the daily volume of traded calls against the daily volume of traded puts.

The Put/Call Ratio is also often referred to as the PCR or the PC Ratio and is usually calculated by taking the number of traded put options and dividing it by the total number of traded call options. The result of this calculation is the PCR ratio, and it is typically displayed as a rolling 7-day average.

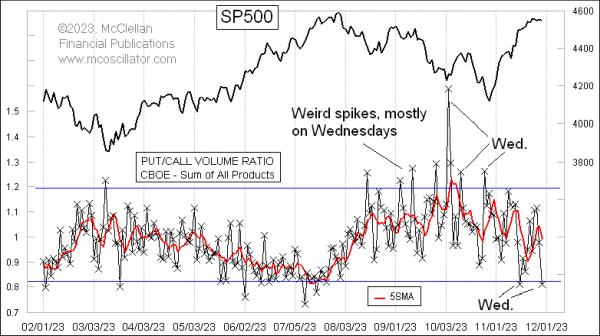

A call option gives the buyer the right, but not the obligation, to purchase an asset at a predetermined price, while a put option gives the buyer the right, but not the obligation, to sell an asset at a predetermined price. When the PCR goes above 1.0, it typically indicates a bearish sentiment in the markets and can anticipate a selloff. Conversely, when the PCR goes below 1.0, it typically signals a bullish sentiment and can be used to anticipate an increase in asset prices.

The Put/Call Ratio is widely used as an indicator of market sentiment for stocks, indices, and other financial instruments, and is the most common tool used by traders to gauge investor sentiment for specific stocks or securities.

To make the most effective use of the PCR, traders often turn to what’s known as “Weird Wednesdays”. On Wednesday’s the stock market tends to display more bearish sentiment due to investors having less time to make decisions and being more likely to offload shares in order to make quick gains. A PCR reading that’s higher than normal on a Wednesday can indicate a developing bear market.

Though the PCR shouldn’t always be looked at in isolation, it can be a useful tool to help anticipate changes in sentiment in the stock market. The PCR can help inform when an investor should buy or sell stocks and thus can help maximize profits as a trader. Furthermore, traders can use the PCR to double-check their decision-making and validate their beliefs about the future direction of a particular stock or asset.

To sum it up, the Put/Call Ratio can be an incredibly helpful tool to traders wishing to better predict the direction of the stock market. Through this tool traders can gain valuable insight into the prevailing sentiment of stocks and securities, and thus make more accurate decisions.