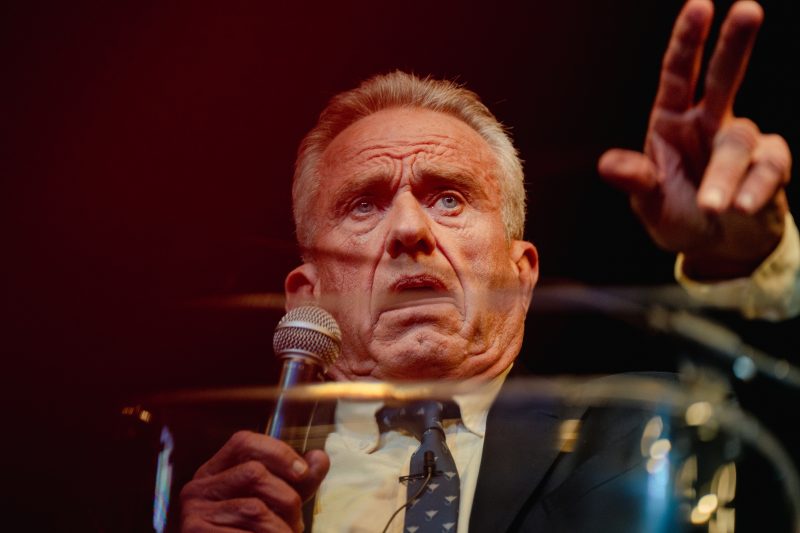

The recent controversy surrounding Robert F. Kennedy Jr.’s comments on the housing bubble has left many scratching their heads and looking for answers. The strategy outlined by Kennedy – claiming that the real cause of the 2008 financial crisis was the bursting of the housing bubble – makes sense on paper, but evidence has since emerged exposing the flaws in this theory.

Though Kennedy’s hypothesis appears to be a compelling argument on the surface, a closer look reveals a major flaw – the lack of any direct evidence connecting the housing bubble with the financial crisis. The housing boom and subsequent collapse began long before the actual market meltdown, which occurred in September 2008. The true cause of the crisis remains unknown, and Kennedy’s theory seems to be built on circumstantial evidence rather than hard facts.

Furthermore, Kennedy’s claim that the government attempted to “bury” this alleged conspiracy by bailing out the banks involved ignores the fact that the Federal Reserve was legally obligated to intervene in the crisis. According to the Federal Reserve Act of 1913, the Fed’s purpose is to act as a lender of last resort in times of economic stress. This is precisely what it did in 2008, and its actions were consistent with its mission and the law.

Though Kennedy’s hypothesis is intriguing, it relies on conjecture rather than facts. His theory may have been convincing to some people, but the evidence simply does not support it. Where Kennedy’s theory fails, it leaves a gaping black hole – a void that remains unexplained and unanswerable. The real cause of the financial crisis may never be known, but the baseless assertions by Kennedy do not seem to be the answer.