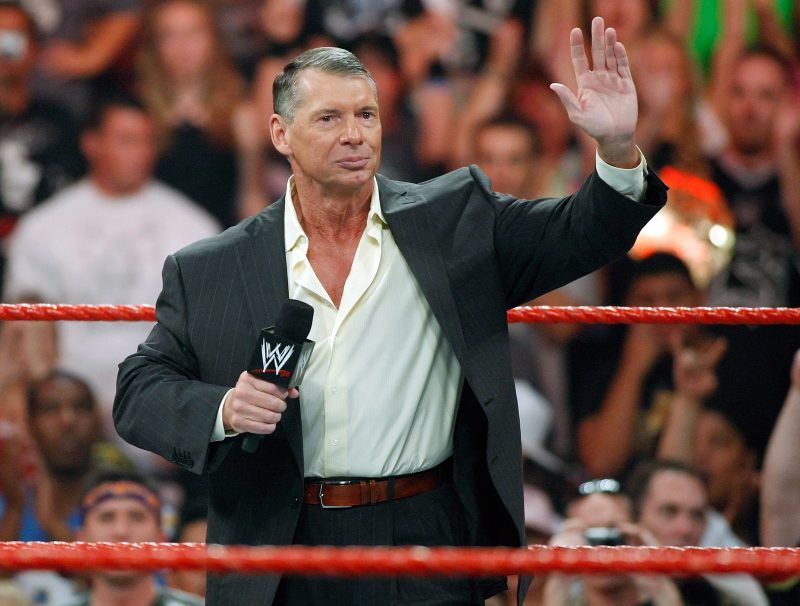

Vince McMahon’s decision to sell a chunk of his shares in WWE parent company TKO has sent shockwaves throughout the world of professional wrestling. The news came as a surprise to many, as McMahon has been the face of the company for decades.

McMahon’s business acumen has been the driving force of the WWE’s success over the years, but now the chairman has decided to take a step back and allow the business to move to the next stage of growth without his direct involvement. McMahon’s decision to sell his shares in TKO is part of a larger exit plan that will see him step away from day-to-day operations within the company.

TKO, an international sports entertainment group, acquires, develops, and manages content and distribution for the WWE’s global network. The company is owned by World Wrestling Entertainment, Inc., and has become a driving force of the business through its strategic partnerships and innovative marketing. The company reaches millions of viewers in over 150 countries.

McMahon reportedly sold a sizeable chunk of his shares in TKO to private equity firm Silver Lake Partners. The investment, which could be worth up to $500 million, will give Silver Lake a stake in the TKO’s future. This move is clearly designed to bring in big-money investors to the WWE’s parent company, as well as providing the company with some necessary cash flow.

It remains to be seen what impact the sale of McMahon’s shares in TKO will have on the WWE. But many fans are hopeful that it will lead to further investment into the company, resulting in better pay and improved working conditions for the wrestlers, and ultimately a better product for the fans.

Ultimately, McMahon’s decision to sell a big chunk of his shares in TKO will likely bring a degree of stability to the company’s future, and is likely to attract new investors in the coming months. How this move will affect the WWE’s operations in the short-term are yet to be seen, but one thing is certain: Vince McMahon will always remain an icon in the world of professional wrestling.