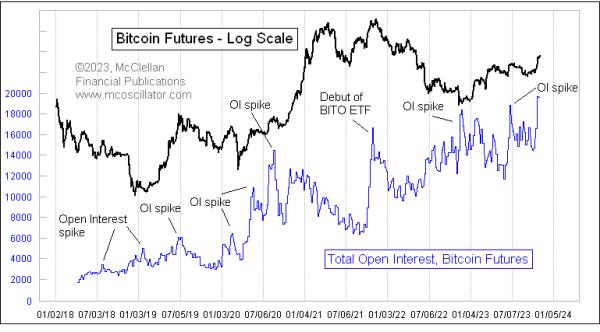

In recent months, the mainstream financial world has become more and more interested in the cryptocurrency sector, and particularly the flagship asset Bitcoin. This is evidenced in part by the recent surge of new open interest in Bitcoin futures, as registered exchanges are increasingly facilitating a wider range of trading opportunities.

According to data from exchanges, such as CME and Bakkt, traders are increasingly seeking short and long term exposure to cryptocurrency markets. This surge in open interest was led by Bakkt, whose Bitcoin futures contracts saw an enormous spike of over 200% in just a few weeks. The CME followed up with an 80% increase, likely due to the increased confidence in the cryptocurrency market and the growing investor interest.

Despite the still relatively small size of the Bitcoin futures market, the recent surge in open interest is a positive indicator for the health of the cryptocurrency space in general. The open interest indicates that more people and institutions are now taking the plunge into cryptocurrency trading, which could potentially provide some stabilizing liquidity to the still volatile asset. Furthermore, it signals that large investors and traders are growing increasingly confident in Bitcoin, and are looking for ways to gain exposure to the asset without having to buy physically.

These are encouraging developments for Bitcoin and the wider cryptocurrency sphere, as more entryways to the space create opportunity for further adoption and acceptance. As open interest continues to surge, it could possibly pave the way for even bigger investments from traditional finance entities, introducing more liquidity and stability to the asset. As the industry matures and more cryptocurrency trading solutions are made available, this could prove to be an invaluable development in the future of digital assets.