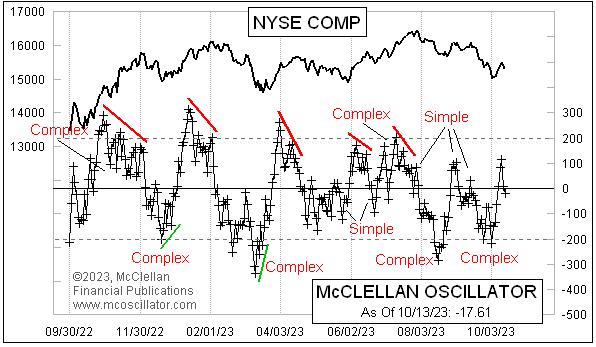

When it comes to analyzing market trends, one of the most popular indicators is the McClellan Oscillator. This indicator, developed by Sherman and Marian McClellan, is a widely used technical tool to gauge the speed and changes in the market. It uses the moving average of the difference between advancing and declining issues to accurately predict market sentiment.

The McClellan Oscillator ranges from -100 to +100. When it’s above +50, that is a signal the market is in an uptrend. This is an indication for investors to buy stocks or long positions. On the other hand, if the indicator is below -50, the market is in a downtrend. Thus, this is an indication for investors to sell stocks or open short positions.

The McClellan Oscillator often leaves a simple structure above zero. This means that the indicator generally has two patterns – a flat one and an uptrend. When the indicator is above the zero line, the market is in an upward direction. Therefore, investors should take advantage of these market conditions and consider buying stocks or long positions. On the other hand, when the indicator is below the zero line, the market is in a downward direction. Thus, investors should be cautious and consider taking action to exit the existing positions.

A drop in the McClellan Oscillator indicates a decrease in the difference between advancing and declining stocks. This is often an indication that the market is about to enter a correction phase. Therefore, investors should pay attention to the magnitude of the drop and be prepared to modify their trading strategies accordingly.

In conclusion, the McClellan Oscillator is a powerful technical indicator that traders use to identify trends in the stock market. It leaves a simple structure above zero which generally has two patterns – a flat one and an uptrend. By using the McClellan Oscillator, traders can decide whether to buy or sell stocks, and when to take profits or cut losses.