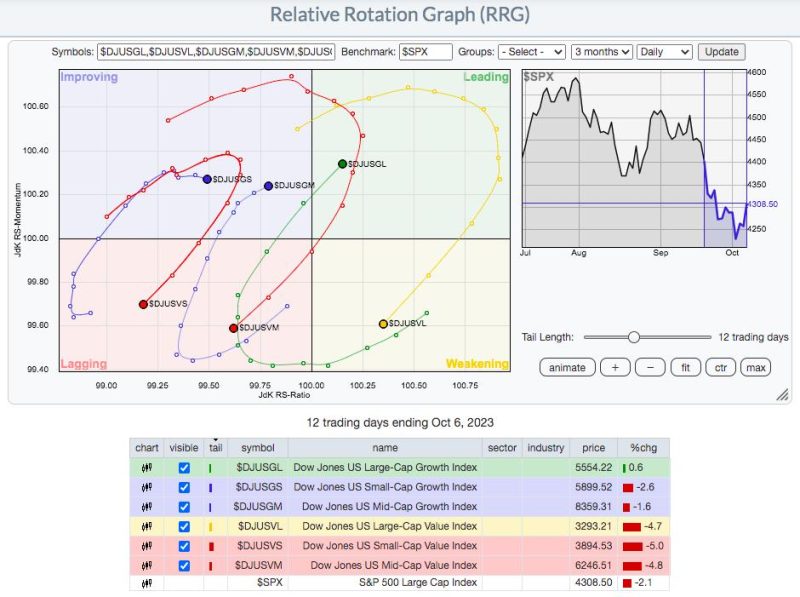

The RRG, or Relative Rotation Graph, is showing an explosive growth in stocks, even though the Federal Reserve is trying to put the brakes on. This could lead to a scenario, where the Fed may have to become more aggressive in its money policies, applying higher rates to markets to try and slow the growth.

The RRG’s relative strength index rose to its highest level since the Great Recession of 2007-2008. This indicates that investors are becoming increasingly confident in the stock market and are flocking to the higher-risk investments. This is leaving the more stable investments, such as government bonds, in the dust.

This dynamic is being driven by increased investor confidence, particularly in investing in tech stocks. The tech sector is going through a bull market, with the NASDAQ Index climbing to record highs. As investors have seen over the last few months, tech stocks can generate enormous rewards. This has been a draw for retail investors, who have been reaping the benefits of gains in stocks.

The RRG divergence is causing some concern for the Fed, however. While the overall economy remains in good health, there are concerns amongst economists about the rampant growth of stocks. This could lead to an unsustainable situation, where the Fed may have to take more drastic action to curb the growth of stocks such as higher interest rates.

Despite these concerns, some economists believe that the current stock market environment is part of a healthy rotational cycle, where investors move in and out of stocks to maximize returns. This also suggests that the current RRG divergence is part of a larger cycle, rather than a sign of out-of-control stock investments.

Overall, the RRG’s explosive growth in stocks is both a blessing and a curse. On one hand, it’s a signal of a sound and healthy economy, with the tech sector being the main driver of growth. On the other, it could be an indication of an unsustainable stock market, which could force the Fed to take more aggressive action to slow the growth. In either case, investors should be aware of all the implications of this dynamic and adjust their investing strategy accordingly.