In today’s world, it’s essential to stay on top of the market and know the direction it’s headed in. There are three key relationships which can be used to assess market direction, and all investors should be familiar with them.

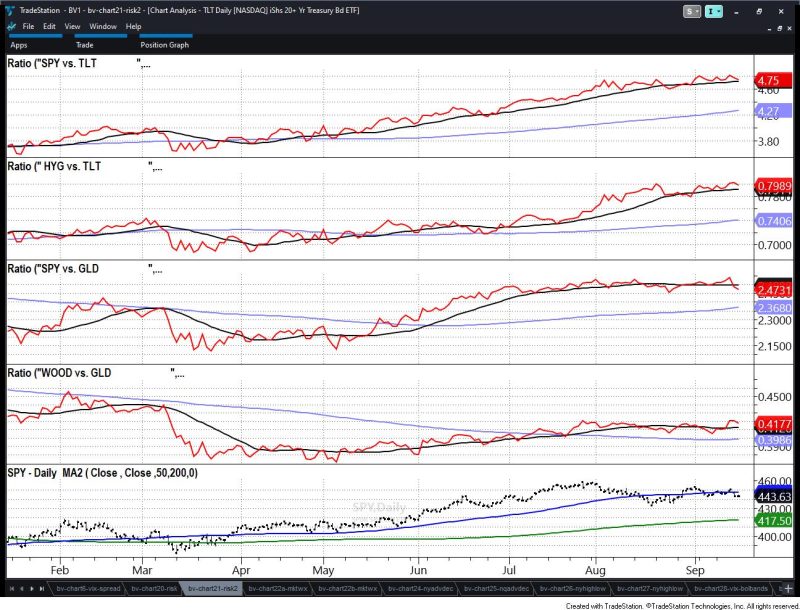

The first is the relationship between bond prices and stocks. A strong bond market suggests economic growth, as the bond market takes a leading indicator of economic activity. A strong stock market also suggests economic growth, although it can also be driven by speculation. When the bond market and stock market are both strong, the market is said to be in an uptrend.

The second is the relationship between currencies and stocks. A strong currency means that more people are willing to buy and sell the currency, which helps increase the demand for a currency. This, in turn, creates demand for stocks in the same currency, driving up their prices. Conversely, a weak currency suggests a weak economy, and this could impact stock prices.

Finally, there is the relationship between commodities and stocks. A strong commodity market suggests a strong economy and can provide a positive impact on the stock market. Conversely, weak commodities indicate a weak economy, and this can have a negative effect on the stock market.

By monitoring these three key relationships, investors can better assess market direction and make informed decisions. This knowledge can be used to build a successful and long-term investment strategy. Keeping an eye on the bond market, the currency market, and the commodities market can help investors make informed decisions for their portfolios.