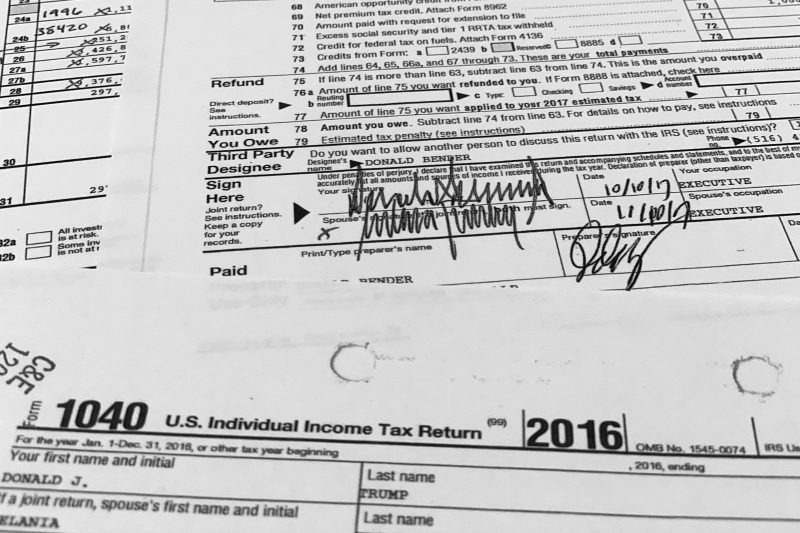

Taxes and tax return information are not something most people want to talk about, let alone have their information leaked. Unfortunately, an IRS consultant has been charged with improper disclosure of tax return information for Donald Trump and several other wealthy Americans.

According to a recent statement from the Department of Justice (DOJ), the charges stem from the inspector general of the Department of Treasury’s investigation of suspicious activity within the IRS. The inspector general found that the IRS consultant, Johnathon M. Singh, had improperly disclosed several tax return information to a private party without authorization.

The DOJ alleges that Singh accessed and shared information between August and September of last year. The private party is not named in the statement, but is referred to as an “actuarial consulting firm.” It is not known if the consulting firm was working for anyone connected to the president, or any of the other wealthy Americans whose tax return information was allegedly provided.

This situation is especially troubling because the tax returns of millions of Americans are kept confidential and should not be shared with non-authorized persons or entities. The DOJ is taking this case very seriously, and has made it clear that no individual or institution is above the law.

In a statement released after the announcement of charges, the Treasury Department’s inspector general described the situation as “an affront to the integrity of our tax system” and that the department “will not tolerate this kind of behavior.”

Singh has been charged with one count of willful unauthorized access and disclosure of tax return information, one count of conspiracy to commit unauthorized access and disclosure of tax return information, and one count of false statements.

If convicted, Singh could face up to 10 years in prison and up to a $250,000 fine. The DOJ stressed this case emphasizes how seriously they view any violation of taxpayer privacy and pledges to prosecute any individual or group that violates these laws.

Taxpayers should take comfort in knowing that the government is willing to take such action in order to ensure the safety and privacy of their information. Those who are concerned about their own tax information should contact the IRS directly to ensure that their finances are secure.